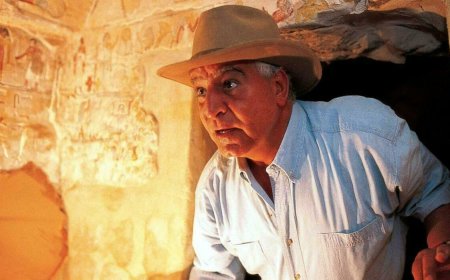

Egypt a Tax Paradise just a few steps from your city!

Business in Egypt! Costs and Taxes, to Start Your Own Business in Egypt ...

Private enterprise in Egypt.

It can be exercised by a natural person; the limits of the share capital are not established. If the trading capital is less than EGP 20,000 then no accounts need to be kept. The founder must be an Egyptian, if he doesn't export. A private entrepreneur whose capital constitutes and exceeds 20,000 EGP (LE), must keep accounts according to an established form. Annual profit of a private company, including other taxable income, must be taxed.

Limited Liability Company in Egypt.

Minimum share capital: 1000 LE, must be paid at a rate of 100% in a bank, before the foundation of this type of company. Number of partners: at least 2 founding members, they can be foreigners. Each founding member is responsible in the measure and proportion of the contribution to the share capital of the company. Management: one or more managers, in addition one of them must be an Egyptian, has the status of the director.

Joint-stock company in Egypt.

Minimum share capital: 250000 LE, 25% bank deposit. Payment can be made in installments: 10% - before the foundation of the company and 15% - within 3 months, and the rest must be paid within 5 years. In this way, not less than 50% of the share capital must be owned by the founders, not less than 25% of the share capital must be paid during the period of the founding of the company, and the rest - within 5 years . Number of partners: at least 3 founding members, they can be foreigners. Each founding member is responsible in the measure and proportion of the contribution to the share capital of the company. A foreign company can open a branch of the company or a representative office. However, it cannot carry out commercial or mediation activities in Egypt independently and autonomously. In case of need of the organization of the service or sales network, to promote its products or services in Egypt, a foreign company must enter into a contract with a commercial agent (a commission agent of a supplier, a distributor) in accordance with the law of RAE "About commercial agencies".

Taxes.

The Egyptian Taxation System is very simplified and convenient, in fact following a declaration with self-certification of the annual proceeds there is a corresponding tax of 14%! Only 14% tax is claimed on the total proceeds in the fiscal year in question.

In our opinion, a real tax haven! In any case, for specific information you can contact a professional Business Consulting Agency such as Sharm Business, Italian Agency based in Sharm el Sheikh.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0